Payday Loans in Canada

Don't wait any longer, and take the pressure off your everyday life by applying now for your payday loan in Canada. It's simple, fast, confidential, and secure. Apply now for payday loans Canada

What are Payday Loans in Canada?

The unexpected is part of life; are you facing an unexpected expense or an urgent financial situation?

A payday loan in Canada is probably the best answer to your problem. This short-term financial solution is designed to help you temporarily overcome an unexpected financial obstacle. In addition, the loan allows you to avoid running out of money before your next paycheck if you are in need.

How can a short-term loan help you?

Need to make an emergency repair to your car? Have an unexpected medical expense or a late payment on a neglected bill? All of these situations can arise daily when you least expect them. By taking out an immediate loan, you give yourself the ability to deal with them and get back on track quickly. Free yourself from this burden by applying online now.

Some of the other needs an emergency loan can help you with include:

Hospital Bills

Health-related emergencies are unpredictable. The emergency might be caused by accident or maybe just falling ill. While ill health is the last thing you might want to happen,it is a part of life and may lead to high hospital bill. If you face this type of financial difficulty, your best bet could be taking a payday loan and repaying it on your next payday.

Rent

Is your landlord on your case due to unpaid rent? Do you find it hard to relax at home because you fear the wrath of your landlord? You can get an emergency loan and pay your apartment’s rent to avoid a tussle with your landlord. An instant payday loan in Canada could save you from late bills which could lead to eviction from your apartment and save you the stress of unpaid rent.

Daily expenses

You might run out of money to buy household items which are crucial for your survival. Such situations are unexpected and may occur when you can’t access any money. An online payday loan in Canada should get you back on track financially. You shouldn’t suffer financially while you wait for your next payday.

Avoid having a bad credit score.

You might have taken a loan, and its payment is due. However, you might not have adequate money to pay the loan. A late payment of credit card debt could damage your credit score, especially if you had taken the loan from the bank. Your credit score needs to be at its best so that you don’t have trouble taking another loan in the future. Save the integrity of your credit score by getting an emergency loan. Such loans come in handy until you get cash to pay back the loan.

Are Payday Loans Legal in Canada?

Yes, payday loans are legal in Canada. They are permitted under section 347.1 of the Criminal Code. The regulation states that the province of the borrower has to enact sufficient provincial legislation attributed to the payday loans in Canada. If such laws are not in existence, then payday loans are regulated by Usury Laws.

The law limits the rates charged on the issuing of payday loans in Canada. An effective compound interest rate charged above 60% is illegal. To avoid being on the wrong when you apply for an online payday loans, it is recommended that you be familiar with the regulations. The regulations vary from one Canadian province to another.

Any borrower is regulated by the relevant implemented laws specific to their province. The regulations vary and extend from capping on the interest rates and canceling an online loan.

Why you should get Payday Loans in Canada?

No credit check

You will be pleased to know that no credit check is conducted when you apply for a payday loan. Therefore, you can get a loan even if you have a bad credit score unlike those applying for traditional payday loans. Traditional lenders are different from us, online lenders who offer payday loans since they will conduct a credit check before they approve your loan application.

Collateral or any other security

Banks and other traditional lenders will want to take collateral when they give you a loan. This is because you might not have one at the moment, yet you need the money. Online payday loans will not ask for collateral, and you will get your money by proving you are employed.

Instant approval

If you need money urgently, our online payday loans have got your back. You can notice this from the brief application process that will take less than an hour to complete. If you are successful, your loan application will be approved within a couple of hours, and you will get your money in your bank account immediately.

No need for tons of documents

Remember the last time you applied for a loan from a traditional lender? It must have been hectic carrying around all those documents that were needed. This is not the case when you apply for an online payday loan in Canada. You won’t have to carry all those documents or even submit them. This works to streamline the application process for you as the borrower.

Online application

Unlike traditional lenders, you don’t have to come to our offices to complete a loan application. Neither will you have to wait in long lines. Instead, you can apply for a loan on your smartphone or tablet.

Physical location

Traditional lenders have physical locations, which sort of limits their reach to their clients. Moreover, you have to access them within specific hours of the day. However, we are an online platform that allows 24 hour access and you can also seek clarification by contacting our customer care team on the phone.

Why Choose Get My Pay Today for your Payday Loans in Canada?

There are several advantages to doing business with Get My Pay Today for your payday loan:

- Immediate cash loan

- Adaptation to your needs

- Desire to help you

- Transparency

- No credit check required

- Entire Canada served

- Easily Accessible

Transparency

When you transact with us, there is no hidden agenda. We have developed our platform to be fully transparent to you as our client. This begins with the interest rates you will be charged on a loan that you take and all other factors.

As a client taking a loan, all that you need to know is disclosed on the website. This should win your trust, and there shouldn’t be any worry about hidden charges on any loan that you take.

No Credit Check Required

You shouldn’t worry about getting funds if you have a poor credit score. We don’t perform a credit check to consider your eligibility for an online loan. Therefore, we can give you our bad credit loans in Canada, even if you have a bad credit score. Thanks to a high approval rate, you should get funds instantly when you apply for an online payday loan.

Unlike traditional lenders, no credit check will be conducted. This benefits you to pay a previous loan and better your credit score altogether.

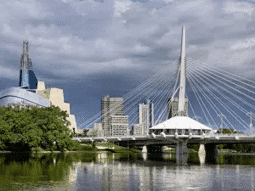

We Serve the Entire Canada

Our online payday loans in Canada are available all through Canada. You can reach our services from any part of the country. All you have to do is get to our website and begin the application process.

We are glad to extend our online payday loans to all corners of the country. Convenience is achieved since you won’t be forced to visit our physical location. This saves you time and gets the money to you instantly.

Easily Accessible Customer Care Team

You will be glad to know that you can access our customer care team any time of the day. We have numerous staff members at your beck and call. They are ever ready to respond to any issue that you might have. The numbers also ensure that you don’t have to wait for long before you get a free customer care staff.

You can contact them at any time and any day of the week. This should make it easy for you to get a clarification on any matter that you don’t understand.

Requirements for payday loans

Don’t wait any longer, and take the pressure off your everyday life by applying for your payday loan now. It’s simple, fast, confidential, and secure.There are a handful of requirements that you will need to meet when applying for an online payday loan. They are listed below:

An indication of legal age

You should have an ID showing you are of legal age

An active bank account

Your bank account details will be needed. This is the destination where the loan will be deposited in.

Proof of income

You will need to show that you are inactive employment. A reliable source of income will do. This is the major detail that the lender will use as security when advancing a loan to you.

Payday loan: Online Application Process

Once you have all the requirements needed for an application for a loan, you can start with the application.

- Apply online: on our official website, click the online loan application form

- Fill the form: fill the application form with personal information and any other details that will be needed. An important detail is a bank account you will want the money to be deposited in

- Wait for verification: one of our staff will contact you to verify the application for the loan

- Wait for approval: After completing the application part of the loan, you wait for the approval. The probability of your application going through are high. The results of your application will not take more than an hour before you get a response.

- Receive the funds: After a successful application, the loan will be approved, and the funds will be deposited into your bank account.

Contact Get My Pay Today for your Payday Loans in Canada

If you are in an emergency and need money instantly, we are here for you. Contact our team and apply for an online loan that will take a couple of hours to be completed. With our high approval rates, you should get the funds deposited into your account within the next 24 hours.

Get significant amounts of money even if you have a poor credit score. Our instant application process guarantees that you can cover any emergency financial situation. The online payday loan should effectively bridge the gap until you get your hands on your next salary.

Main provinces served in Canada | Payday Loans

Other cities served in Canada | Payday Loans

Need a loan for any project ?

Why choose Get My Pay Today?

An immediate cash loan

An adaptation to your needs

A sincere desire to help you

Payday loan: Online applications processes

Don't wait any longer and take the pressure off your everyday life by applying for your payday loan now. It's simple, fast, confidential and secure.

FAQ

A payday loan is a short-term loan. It is often used to cover unexpected expenses, late penalties, bad cheques, one-time cash shortages. These personal loans are immediate solutions that help you bounce back and pay your bills but are not meant to be used for the long term.

The amount of money you can borrow is defined. We calculate how much online payday loan you are eligible for by considering how long your account has been active.

We may also consider your loan repayment history to determine what loan amount best suits you. The maximum amount that a borrower can obtain is also regulated by the laws of the province they are in.

You will need to provide us with some personal information and documents for your application to be approved. No credit score investigation is required, and you don’t have to pay anything before you receive your money.

You will receive a response within an hour if you submit your application online during our business hours. Would you like to speed up the process? Then, come and meet us in person to receive your cash within 30 minutes.

No, you will never be asked to pay anything before you get your loan.

No, we do not require a credit check to give you a cash advance. Instead, our goal is to help you move forward without letting your past hold you back.

The documents that will be needed by payday lenders to give payday loans in Canada include:

Two pieces of photo identification and proof of your Social Insurance Number.Proof of address (service invoice)Your last two pay stub sample Cheque – Pre-Authorized Debit Form The last 90 days of your bank statement

Money will be deducted from your bank account on the due date of the online payday you took according to the loan agreement. When you agreed to take the online payment loan, you granted access to your bank account to your lender. Therefore, when your next salary is deposited into your account, you will be automatically deducted.